You may be wondering where to start when looking for a mortgage broker. Here are 5 key tips for how to find a lender for a mortgage to help you out!

Finding a good mortgage broker can save you money on interest rates and fees. Most importantly, they save you time, anxiety, and stress throughout the home buying process. It also helps to have someone who knows the industry inside and out. Someone who will empower you to make the best decision for you.

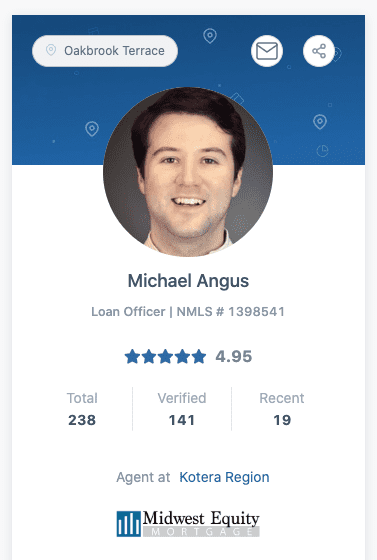

After buying our first home, refinancing our home, getting pre approved for and putting an offer on a second home, here are my best tips for finding a great mortgage broker. In fact, I sat down with our broker, Mike Angus of Midwest Equity Mortgage. We talked through the best tips for finding a mortgage broker who will enhance your experience throughout the home buying process.

Finding a Lender Tip #1: Ask Friends & Family

If you’re not sure where to find a trusted mortgage broker, ask friends and family for recommendations. When we were refinancing our home in early 2022, we decided to ask friends in our area who they had refinanced their home with. Your friends and family will give you an honest opinion about their experiences and a sneak peek into the process. We got three recommendations and I began calling each one, using my friends as a reference. Each time, I started off on a friendly note, because there was a connection and mutual contact. This is how we found Mike.

When we first bought our home, we asked our real estate agent for a lender recommendation while researching well-known Big Banks in our area. While we didn’t have a terrible experience with the Big Bank we went with, we also did not feel particularly supported through the process.

How To Find A Lender Tip #2: Don’t Just Look at the Big Banks

Many first time home buyers may feel more comfortable looking into mortgages and rates from Big Banks only. We felt this way at first too. One of the banks we contacted was so bureaucratic, we couldn’t get a real person on the phone to speak with us. Not even to get an initial quote. The Bank we worked with gave us a significantly better rate than the smaller lender our real estate agent recommended. This was our main deciding factor. However, we mostly felt like we were just a number and didn’t get any real education throughout the process.

As Mike points out, “Bigger banks tend to provide slightly better rates but that is about the only advantage I would guess. Would you rather get the lowest rate possible and have poor customer service or pay maybe .125%-.25% higher in rate but have the comfort of knowing exactly where you are at in the home buying process? People need to realize that the cheapest rate more often than not comes with poor customer service.”

Another thing to consider is that Big Banks don’t always specialize in mortgages, since they have a lot of other products and services.

Finding a Mortgage Broker Tip #3: Pay Attention to What They Say

It’s also helpful to pay attention to how a mortgage broker describes themselves. Do they specialize in mortgages for first-time homebuyers? Which states are they licensed in? How do they describe their services? These questions should help you narrow down your search by giving you an opportunity to assess how they communicate with you. You can also learn who they’ve worked with before. Finally, you can gauge how dedicated they are to making your experience as smooth as possible.

Finding a Mortgage Broker Tip #4: Ask These Questions

If you’re still not sure who to choose, ask these questions to find out more about each company and who you will be working with if you choose that mortgage broker. Consider what it would be like to work with a lender before you commit to working with them.

- How do you educate your clients about the underwriting and loan process?

- How do you communicate with your clients at each step of the loan process?

- How do you help clients overcome any obstacles or snags they might encounter along the way? Do you have an example of a time when you helped a client get through a challenging situation with their loan?

- Do you offer creative solutions in order to get the best loan option I can qualify for?

Three key things Mike and Midwest Equity Mortgage provide that made our experience smooth and easy were:

- Education – Even before we decided to work with Mike, I was impressed with the information he gave us right up front. We received a PowerPoint that walked us through some projections and trends in market rates. It also highlighted information about the history of mortgage rates in the U.S. This gave us a better understanding of the context of today’s market. It also made Mike stand out, because we hadn’t received any of that information from other lenders we’d talked to. We certainly didn’t receive this level of information from the Big Bank we had gotten our first mortgage from. I also had several conversations with Mike about our goals for our refinance and what we were looking for. He walked me through a few options based on California state laws. This really helped me see the bigger picture.

- Communication – We got emails, texts and calls from Mike along each step of our underwriting process. This allowed us to know exactly what to expect during every stage. The updates even included how long we could expect each phase to take. This was comforting and made the process much more pleasant. We were never left guessing about anything during our refinance.

- Creative Solutions – A great mortgage company should be able to find solutions for all parties involved. Mortgage brokers often have a broader range of loan products than you might be able to get at a Big Bank. They can also walk through all different scenarios to help you figure out what’s best for you.

How to Find a Lender Tip #5: Compare Lenders, but Limit Yourself to Around 3.

Less is almost always more in this situation. One of the mistakes first-time home buyers make is giving themselves too many choices. Once you’ve contacted 3-4 lenders and had conversions with them about how much you can qualify for and at what rate, you’ve gathered enough information to make a decision.

Pay close attention to Tip #4 when making your final choice, since how mortgage lenders handle these three areas make a huge difference for your experience and your home search as a whole.

Finding A Lender for a Mortgage, Bottom Line: Look for Three Key Things – Education, Communication and Creative Solutions

I’d highly recommend working with Mike on your home loan. He’s licensed in Arizona, Arkansas, California, Colorado, Florida, Illinois, Indiana, Maryland, New Jersey, North Carolina, Oregon, South Carolina, Tennessee, Texas, Virginia, Washington, and Wisconsin.

For more home buyer tips and finding the best real estate professionals, check out my interview with Laura Moreno of Home Flow.

Home Flow also provides assistance connecting you with the right real estate agent for your home search.

4 Comments on 5 Tips for How To Find Lender For A Mortgage